Autopay Online Payment Gateway - DocumentationPobierz

Autopay Online Payments is a comprehensive solution for accepting payments from customers of online stores, supporting various payment methods available on the market, such as transfers, Pay by link, BLIK, Google Pay, Apple Pay.

In this documentation, you will find everything you need to quickly implement the payment gateway in your online store.

The Autopay Online Payments documentation includes sections such as Transaction and Settlement Management, Additional Extensions.

Definitions

Application – Partner's Mobile Application, communicating with the Autopay Online Payment System SDK to register Transactions.

AP – Autopay S.A. Company, headquartered in Sopot, at Powstańców Warszawy 6, registered with the District Court Gdańsk-North in Gdańsk, Commercial Division VIII of the National Court Register under KRS number 0000320590, with tax ID (NIP) 585-13-51-185, REGON 191781561, with share capital of 2 205 500 PLN (fully paid), supervised by the Financial Supervision Commission and registered as a national payment institution under IP17/2013, owner of the System.

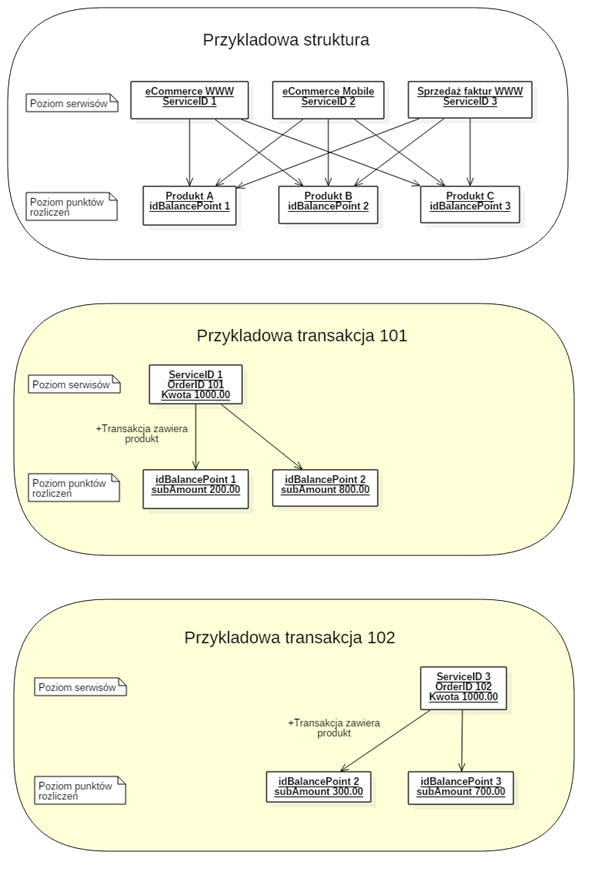

BalancePoint (Settlement Point) – an entity within the Payment System representing a Store integrated with the Marketplace Platform and registered in the Payment System using a form provided by AP to the Partner.

ClientHash - a parameter in messages; allows a payment instrument (e.g., Card) to be assigned to a Client in an anonymized way. Based on this, the Partner can initiate subsequent charges in the automatic payment model.

CommissionModel – a commission model established with the Integrator. It describes the commission values for transactions transferred to AP and the Integrator.

Business Day – a day from Monday to Friday, excluding public Polish holidays.

Integration Form – a web page where a form is available, allowing the Client to register, edit, or add a new Service.

Payment Instrument (Payment Channel) – a set of procedures or an individualized device agreed upon by the Client and their provider, used by the Client to initiate a payment order, e.g., Card, PBL.

e-transfer tool – a set of procedures or an individualized device agreed upon by the Partner and AP, used by the Partner to initiate a payment order allowing the withdrawal of funds from the balance to the bank account of the Partner or Client and another payment instrument owned by the Partner or Client. The availability of the functionality depends on individual arrangements between the Partner and AP.

Integrator – Integrators are called partners who have implemented Autopay Online Payments in their systems and enable their activation from within their own solutions. Integrators include entities such as Shoper, Sky-Shop, Gymsteer, Selly verifications, FaniMani, AtomStore, Ebexo, Selly Azymut, PayNow, Comarch.

IPN (Instant Product Notification) - immediate notification sent from the Online Payment System to the Partner Service communicating a change in product status. The structure of the IPN is similar to the ITN (extended only by the node product).

ITN (Instant Transaction Notification)- immediate notification sent from the Online Payment System to the Partner Service transmitting a change in the status of the transaction.

ISTN (Instant Settlement Transaction Notification) - immediate notification of a change in the status of a settlement transaction. The system shall immediately transmit notifications of the fact that a settlement transaction has been ordered (withdrawals/returns, if any) and of a change in its status.

ICN (Instant Configuration Notification) - immediate notification of the configuration of a newly registered shop, communicating information about a change in the shop's card status (e.g. in the case of card activation). ICN messages can also be sent in the event of a change in the shop's configuration, a change in its AML data, the enabling/disabling of a payment channel. The provision of functionality is subject to individual arrangements between the Partner and AP.

Card - A payment card issued under the VISA and Mastercard systems, permitted by the regulations of those systems to execute Transactions without its physical presence.

Customer (Payer) - a person who makes a payment on the Website for services or products of a Partner using the System.

Product basket - This is the information about the components of the payment, transferred (in the payment link) to the System for subsequent processing. Each product of the shopping cart is described by two mandatory fields: the constituent amount and a field allowing the transfer of parameters specific to the product.

Payment link - request enabling the start of an Input Transaction (described in part Start of the transaction). It can be used directly on the website (POST method), while in e-mails to customers it should be used Pre-transaction in order to obtain a short link to the payment (GET method).

Verification link - URL directing to the Verification Transfer.

Marketplace - a payment solution operating within the framework of the Autopay Online Payment System. It enables the Partner to operate a sales platform where products or services are offered to customers by the Partner's Contractors. Advanced settlement models for Transactions and Settlement Transactions allow payments to be made directly from the Customer to the Partner Contractor, taking into account the Basket of products. The provision of the functionality is subject to individual arrangements between the Partner and AP.

Payer Model - a model in which the commission for the transaction carried out is paid by the customer to AP (cost added to the amount of the transaction). In this case, the customer also accepts AP's terms and conditions during payment.

Merchant's model - a model in which the commission is settled between Autopay and the partner and is not added to the amount of the transaction paid by the customer.

Partner - the entity that is the recipient of funds from the sale of products or services distributed by the Affiliate on the Site.

A partner, in the case of the Marketplace model, is an entity, which is not a consumer, interested in handling the acceptance by AP of payments due to the partner for products or services distributed by the partner.

Pay By Link (PBL) - a tool for making payments via interbank transfer from the customer's account to the AP account. After logging in to online banking - the data needed to execute the transfer (recipient's information data, number of his bank account, amount and date of transfer execution) are filled in automatically thanks to the data exchange system between the bank and AP.

Technical Agent - the entity with the right to access the Partner's Payment Account, which authorises this access (consent or agreement). In the system, the power of attorney is represented by the configuration of the PlenipotentiaryID: one entity can have multiple proxies for different Partners.

Marketplace platform - platform on which the option to register Settlement Points is made available.

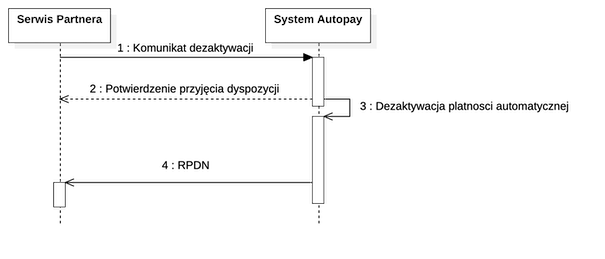

Automatic payment - payment made without the need each time to enter the Card data or the data for authorising transfer.

One-click payment - is an automatic payment ordered by the customer.

Cyclical payment - is an automatic payment ordered without customer involvement (by the Partner Service).

Pre-transaction - specific (performed in the background) ordering payment link.

Verification transfer - The part of the process related to registration and editing of the Partner's Service(s) in the System. It consists of the Partner performing a fund transfer to verify the data and bank account for the disbursement of funds to the Partner. Data verification is an obligation of the AP arising, inter alia, from the Act of 16/11/2000 on the prevention of money laundering and financing of terrorism. Each verification transfer must receive final verification status (positive or negative) within 30 days of payment of the transaction. If the final verification status is not given within the timeframe specified above, the system will automatically give it a negative status. This process applies to verification where Autopay directs a request to complete the data to the customer and does not receive the return information necessary to carry out this verification.

Payment Account (Balance) - payment account maintained by AP for the Partner, on which the funds deposited from Customers are collected. The provision of the functionality is subject to individual arrangements between the Partner and AP.

RPAN (Recurring Payment Activation Notification) - message about activation of the automatic payment service.

RPDN (Recurring Payment Deactivation Notification) - message about deactivation of the automatic payment service.

Serwis - the Partner's website or websites integrated with the System, where the Customer can purchase products or services from the Partner (or from the Partner's Counterparty in the case of the Marketplace).

In the case of a Marketplace, an object in the Payment System representing the Partner's Marketplace. All transactions started by the said Marketplace are attached to it.

Specyfikacja - documentation describing the communication between the Service and the System.

AP Online Payment System (System) - an IT and functional solution whereby the AP provides the Partner with an application to process customer payments made with the use of Payment Instruments, as well as to verify the status of payments and to receive payments.

Fast Transfer - execution of payments via intra-bank transfer from the Customer's account to AP's account. The payment made via PBL differs from payments made via PBL in that the Customer must fill in all the data needed to make the transfer himself.

Transaction - means a payment transaction in the meaning of the Polish Act of 19 August 2011 on payment services.

Input transaction - part of the payment handling process concerning the payment made by the customer to AP.

Settlement transaction - part of the payment processing process, concerning the transfer made by AP to the Partner's account. In order for a Settlement Transaction to be created, the Input Transaction must be paid for by the Customer. A Settlement Transaction may relate to a single Input Transaction (payment), or aggregate multiple of them.

Act - Polish Act of 19 August 2011 on payment services.

Link validity - parameter specifying the point in time beyond which the Payment Link ceases to be active. It should be set by the LinkValidityTime parameter in the Payment Link.

Validity of transactions - parameter specifying the point in time beyond which the Payment Link ceases to be active. It should be set by the LinkValidityTime parameter in the Payment Link.

Autopay widget - a mechanism enabling payment by Card for products/services offered by the Partner, in which Card data are entered by the Client into the mechanism embedded directly in the Partner's Website. Invoking the Card widget format requires the implementation of JavaScript code using a dedicated AP library.

Onboarding widget - a solution that allows the Integrator to embed the Integrator Form (prepared by Autopay) directly on the Integrator's website, so that the Partner is not redirected to the Autopay domain when registering their shop - the whole process is carried out on the Partner's Website.

WhiteLabel - integration model, in which the customer already on the Service selects the payment channel and accepts the rules and regulations (provided the need for their acceptance results from individual arrangements between the Partner and AP), and the start of the transaction includes a completed GatewayID field (and in certain cases DefaultRegulationAcceptanceID or RecurringAcceptanceID).

Initiation of a payment order - the point in time when the payment gateway user selects a payment channel and is redirected to the page according to the selected payment channel or (for automatic payments, e-wallets or BLIK) an attempt is made to debit the card or account at the payment channel provider.

Environment addresses

TEST

-

gate_host:

https://testpay.autopay.eu -

cards_gate_host:

https://testcards.autopay.eu

PRODUCTION

-

gate_host:

https://pay.autopay.eu -

cards_gate_host:

https://cards.autopay.eu

Transaction and settlement processing

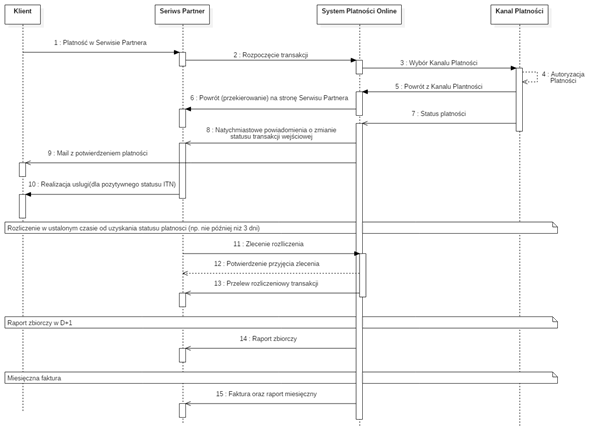

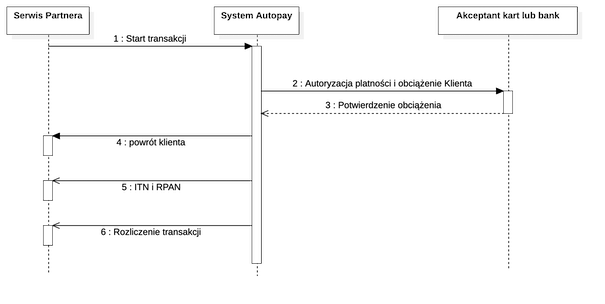

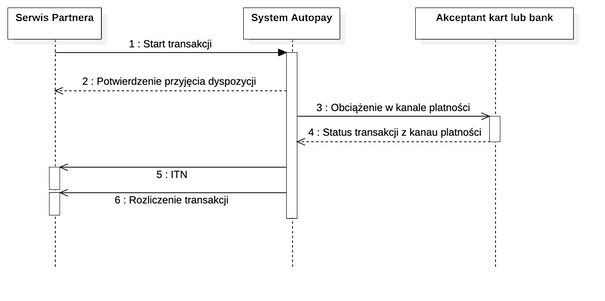

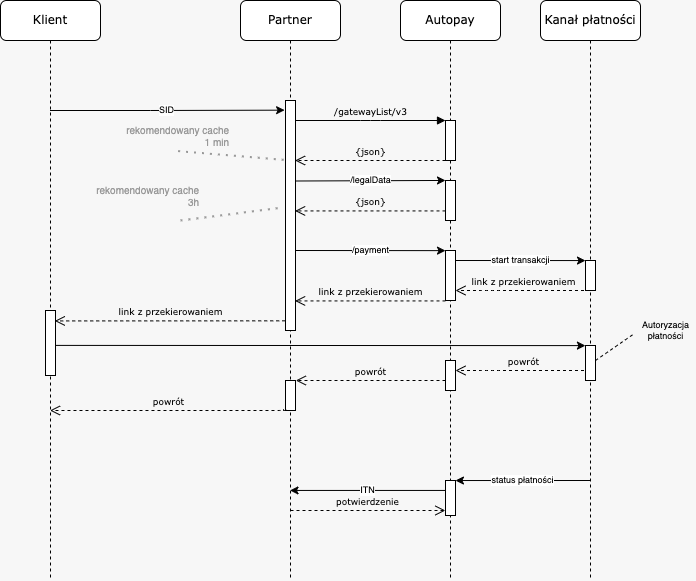

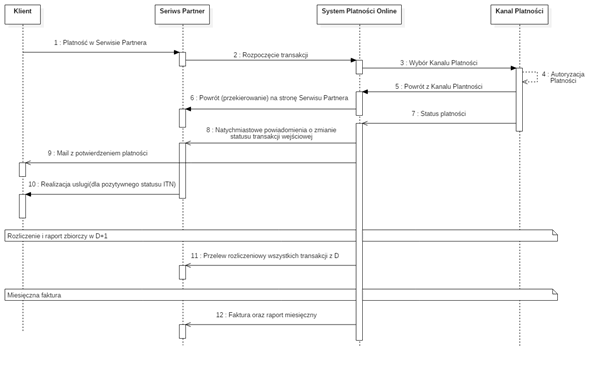

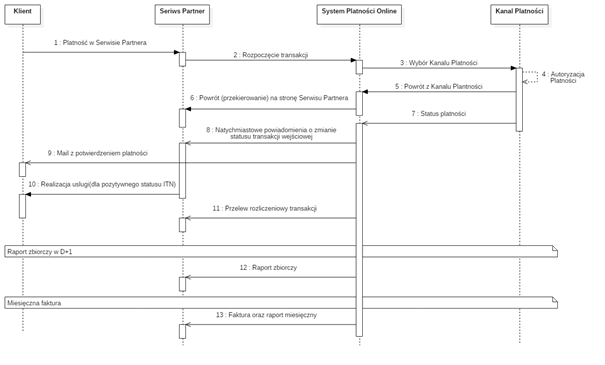

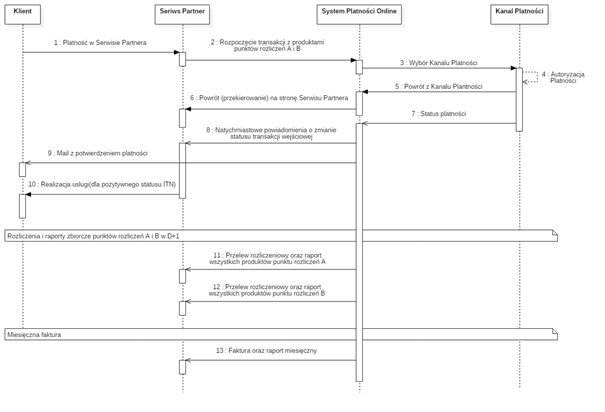

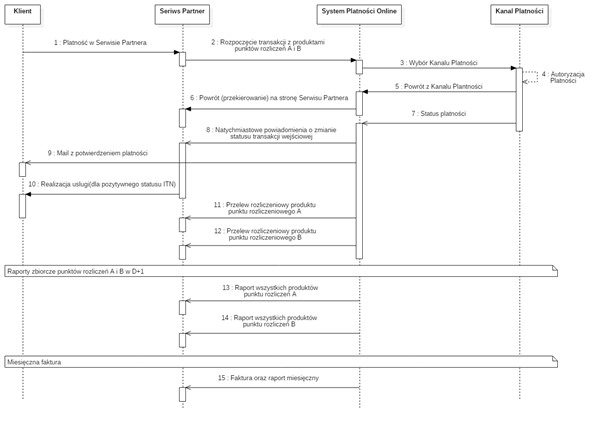

Flow chart of the transaction and clearing service

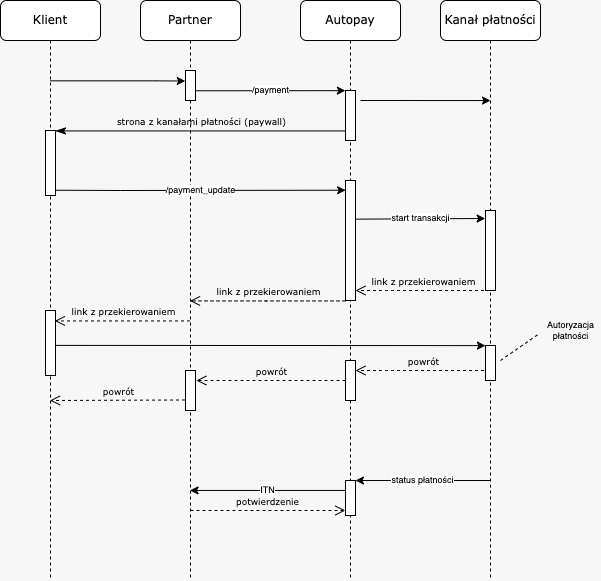

On the Partner Site, after completing the order, the Customer is presented with the option of making a payment using the System. Clicking on the appropriate link initiates the transaction and opens in a new window:

a) a dedicated page of the System prepared by AP, where the Customer is presented with a list of available Payment Channels and a summary of the registered transaction or

b) directly from a Payment Channel (Bank, BLIK or for payment by Card).

On the System's side, the transmitted parameters are validated and the transaction is saved with a fixed validity period. If, at the time of validation, the validity period of the link is already exceeded, the Customer will receive an appropriate message (verification of the validity of the transaction also takes place when the payment status is changed). After positive verification of the transaction parameters (and after selection of the Payment Channel), the Customer authorises the transaction. In its title, in addition to the identifiers assigned by the System, there may also be a fixed description, agreed in advance between the AP and the Partner, or a dynamic value provided by the Partner at the start of the transaction.

The recommended integration model is to transmit a message to start a transaction in the background, i.e. without redirecting the user to the System (see Pre-transaction). In this model, it is possible to use advanced forms of transaction authorisation (WhiteLabel, automatic payments, SDK mobile), diagnosis of the correctness of the transmitted parameters and many other extensions.

Once the transaction is authorised (on the Payment Channel page) the Customer returns from it to the System, where the Customer is automatically redirected to the Partner Service.

TIP: A detailed description of the structure of the return link can be found in part of the Redirection to Partner Site.

The authorisation (payment) status received from the Payment Channel is transmitted from the System to the Partner Service via an ITN message. The System will continue to send messages until the receipt is acknowledged by the Partner Service or the validity period of the notification expires. Transactions which are paid after the expiry of the validity period of the transaction - will be returned to the Customer (sender of the transfer).

Optionally, the System may notify the fact that a Settlement Transaction has been issued. A suitably modified ISTN message is used for this purpose.

Steps for integrating the handling of transactions and settlements

Data required for the integration of transaction and settlement processing

The required data exchanged during integration differs for test and production environments. Below is a list of parameters passed from AP to Partner and in the reverse direction.

General information is also provided, i.e. active payment channels with graphics (as a result of querying the list of available payment channels).

Optionally, there may be additional data transmitted by the Partner to the AP, for example: information about the required content of the shopping cart and the way it is processed (in reports, billing, admin panel), additional requirements (for prepaid balance recharge). For

automatic BLIK payments also the default lifespan of activated automatic payments and the default label of activated automatic payments.

Data exchanged in the test environment

Data provided by the Partner to AP:

- Address for ITN messages

- Address for RPAN messages (may be the same as for ITN messages) [for automatic payments].

- Address for RPDN messages (may be the same as for ITN messages) [for automatic payments].

- Payment return address (no parameters)

Data transferred from AP to Partner:

- Address of the online payment system

- ServiceID

- AcceptorID [for wallets in the WhiteLabel model]

- Shared key

- Hashing result

- Test form address

- IP address from which ITNs are sent

- Address to administration panel

- Login

- Password

Data transferred in a production environment

By Partner to AP:

- Address for ITN messages

- Address for RPAN messages (may be the same as for ITN messages) [for automatic payments].

- Address for RPDN messages (may be the same as for ITN messages) [for automatic payments].

- Payment return address (no parameters)

- Email addresses for transaction reports

- Email addresses for invoices and billing reports

- Email addresses for complaints (sent in messages to Payers)

By AP to Partner:

- Address of the online payment system

- ServiceID

- AcceptorID [for wallets in the WhiteLabel model]

- Shared key

- Hashing result

- Test form address

- IP address from which ITNs are sent

- Address to administration panel

- Login

- Password

Implementation of interfaces and processes on the partner's side

In the minimum version of the integration, support for starting a transaction, returning from it and support for ITN communication should be implemented.

TIP: It is advisable to familiarise yourself with the scheme of operation. If necessary, it is also advisable to familiarise yourself with additional parameters or services.

Integration tests and migration to the production environment

During testing, the white fields of the sheet should be completed and sent back to the AP to confirm correct integration before migration to the production environment.

TIP: Prior to production deployment, it is recommended to perform tests in accordance with the test scenarios in the basic version and, for more advanced integrations, also according to additional scenarios.

Start of the transaction

Description of the start of the transaction

The Partner service initiating the transaction transmits to the Online Payment System the parameters necessary to complete the transaction and the subsequent transmission of the payment status.

All parameters are passed via the POST method (Content-Type: application/x-www-form-urlencoded).

The protocol is case-sensitive in both names and values of parameters. Values of transmitted parameters should be encoded in UTF-8 (and transport protocol - encode before sending, unless the tool used to send the message does not do this itself, encoding example: URLEncode).

List of transaction start parameters

IMPORTANT! The order of attributes for Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | ServiceID | YES | string{1,10} | The Partner Service ID, assigned during service registration, uniquely identifies the Partner Service in the Online Payment System. Numbers are acceptable. |

| 2 | OrderID | YES | string{1,32} | Transaction identifier of up to 32 Latin alphanumeric characters. The field value must be unique for the Partner Service. Acceptable alphanumeric Latin characters and characters in the range: -_ |

| 3 | Amount | YES | amount | Transaction amount. A dot '.' is used as decimal separator. Format: 0.00; maximum length: 14 digits before the dot and 2 after the dot. NOTES: The permissible value of a single Transaction in the Production System is respectively:

|

| 4 | Description | NO | string{1,79} | Title of the transaction (payment); at the beginning of the transfer title, the transaction identifiers assigned by the Online Payment System are placed, to which the value of this parameter is appended. In some cases, independent of the AP, the title of the transfer may be additionally modified by the Bank, in which the payment made by the customer took place. The value of the parameter allows for alphanumeric Latin characters and characters in the range: . : - , spacja. |

| 5 | GatewayID | NO | integer{1,5} | Identifier of the Payment Channel by which the Customer intends to settle the payment. This parameter is responsible in particular for the presentation model of the Payment Channels:

|

| 6 | Currency | NO | string{1,3} | Transaction currency; the default currency is PLN (the use of another currency must be agreed during integration). One currency is supported within ServiceID. Acceptable values only: PLN, EUR, GBP and USD. |

| 7 | CustomerEmail | NO | string{3,255} | Customer email address. |

| 19 | ValidityTime | NO | string{1,19} | Transaction expiry time; when exceeded, the link ceases to be active and any deposit is returned to the sender of the transfer; example value: 2021-10-31 07:54:50; if the parameter is missing, the default value of 6 days is set. The maximum validity of a transaction is 31 days (if the parameter value is set further forward than 31 days, the validity time will be reduced accordingly). E.g. a transaction initiated at 2020-05-01 08:00:00, with ValidityTime = 2021-05-01 08:00:00, will receive validity until 2020-06-01 08:00:00.(Time in CET) |

| 34 | LinkValidityTime | NO | string{1,19} | Link expiry time; when this time is exceeded, the link becomes inactive, but this does not affect the deposit time; example value: 2014-10-30 07:54:50; please ensure that the transaction time is adjusted to the link expiry time (you may also need to enter the parameter ValidityTime, to extend its standard validity). |

| nd. | Hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. |

Method of initiating a transaction

The transaction is initiated by sending an HTTPS call a combination of the above parameters to the address of the online payment system established during registration of the service.

IMPORTANT: The number of transactions launched by the Partner in one minute can be a maximum of 100, unless the Partner and AP agree on a higher limit as part of the concluded agreement.

Example of starting a transaction:

Address:

Parameters:

-

ServiceID=2

-

OrderID=100

-

Amount=1.50

Hash=2ab52e6918c6ad3b69a8228a2ab815f11ad58533eeed963dd990df8d8c3709d1

Sending a message without all required parameters (ServiceID, OrderID, Amount and Hash) or containing incorrect their values, will cause the payment process to stop with a transaction error code and a brief error message (no return to the Partner Service page).

IMPORTANT! The parameter pair ServiceID and OrderID uniquely identifies the transaction. It is not permissible for the value of the OrderID parameter to be repeated throughout the entire period of service provided by the System to a single Partner Service (ServiceID).

The optional parameter GatewayID is used to specify the Payment Channel through which the payment is to be made. This allows the Payment Channels selection screen to be transferred to the Service. The current list of Payment Channel IDs, including logos, is available via the gatewayList method.

The transaction initiation message can be transmitted in the background, i.e. without redirecting the user to the Online Payment System. In this model, the selection of the Payment Channel itself is also made by the Customer on the Partner Service.

Redirection to Partner Site

Description of redirection to Partner Site

Immediately upon completion of the transaction authorisation by the Customer, he/she is redirected from the Payment Channel site to the Payment System online site, where the Customer is automatically redirected to the Partner Service. The redirection is implemented by sending an HTTPS request (using the GET method) to a predetermined return address on the Partner Service. The protocol is case-sensitive in both names and parameter values.

List of redirection parameters for the Partner Site

IMPORTANT! The order of attributes for Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | ServiceID | YES | string{1,10} | Partner Service ID. |

| 2 | OrderID | YES | string{1,32} | The transaction identifier assigned in the Partner Service and communicated at the start of the transaction. |

| nd. | Hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Service. |

Example of a message redirecting the Customer from the online payment system to the Partner Site

https://shop_name/return_page?ServiceID=123458&OrderID=123402816&Hash=5432d69a66d721b2f5f785432bf5a1fc1b913bdb3bba465856a5c228fe95c1f8

Instant notifications (ITN)

Description of instant notifications

The System transmits notifications of changes in the status of a transaction as soon as it receives such information from the Payment Channel, and the message always relates to a single transaction.

NOTE: The domain must be public and accessible via the System. The domain must be secured by a valid certificate issued by a public certification authority (Certificate authority) The server must present a complete certificate chain (Chain of Trust) Communication must be based on TLS protocol version 1.2 or 1.3 *Other forms of connection security, e.g. VPN, mTLS must be individually agreed with the person responsible for implementation.

Example:

https://shop_name/status_receive

Notification of a change in the status of an input transaction consists of the sending by the System of an XML document containing the new transaction statuses.

The document is sent via HTTPS (default port 443) - using the POST method, as an HTTP parameter with the name transactions. This parameter is stored using the Base64 transport encryption mechanism.

Document format (XML)

<?xml version="1.0" encoding="UTF-8"?>

<transactionList>

<serviceID>ServiceID</serviceID>

<transactions>

<transaction>

<orderID>OrderID</orderID>

<remoteID>RemoteID</remoteID>

<amount>999999.99</amount>

<currency>PLN</currency>

<gatewayID>GatewayID</gatewayID>

<paymentDate>YYYYMMDDhhmmss</paymentDate>

<paymentStatus>PaymentStatus</paymentStatus>

<paymentStatusDetails>PaymentStatusDetails</paymentStatusDetails>

</transaction>

</transactions>

<hash>Hash</hash>

</transactionList>

NOTE: A transactions node can only contain one transaction node (so the notification is always for one transaction). The values of the orderID and amount elements relating to each transaction are identical to the values of the corresponding fields provided by the Partner Service at the start of the respective transaction. The exception to this is models where the commission is added to the transaction amount. In such cases, the amount value in the ITN is increased by this commission. The validation of amounts can then be carried out on the basis of the optional ITN field startAmount. However, this field must be requested during integration.

List of returned parameters for instant notifications

IMPORTANT! The order of attributes for Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | serviceID | YES | string{1,10} | The Partner Service ID, assigned during service registration, uniquely identifies the Partner Service in the Online Payment System. Numbers are acceptable. |

| 2 | orderID | YES | string{1,32} | The transaction identifier assigned in the Partner Service and communicated at the start of the transaction. |

| 3 | remoteID | YES | string{1,20} | Alphanumeric transaction identifier assigned by the online payment system. It is worth storing it with the order for further processing (for multiple transactions with the same OrderID, for returns, etc.). Such a situation may occur, for example, if the Customer changes the Payment Channel, calls up the same transaction start again from the browser history, etc. The system allows blocking such cases, but the option is not recommended (it would not be possible to pay for an abandoned transaction). |

| 5 | amount | YES | amount | Transaction amount. A dot '.' is used as decimal separator. Format: 0.00; maximum length: 14 digits before the dot and 2 after the dot. |

| 6 | currency | YES | string{1,3} | Currency of transaction. |

| 7 | gatewayID | NO | string{1,5} | Identifier of the Payment Channel through which the Customer settled the payment. |

| 8 | paymentDate | YES | string{14} | The time when the transaction was authorised, transmitted in the format YYYYMMDDhhmmss. (CET time) |

| 9 | paymentStatus | YES | enum | Transaction authorisation status, takes values (description of status changes further on):

|

| 10 | paymentStatusDetails | NO | string{1,64} | Detailed transaction status, value can be ignored by the Partner Service. |

| nd. | hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Service. |

TIP: Element hash (message) is used to authenticate

the document. For a description of how the hash is calculated, see section Security of transactions.

Response to the instant notification

In response to the notification, an HTTP status of 200 (OK) is expected and

a text in XML format (unencoded Base64), returned by the

Partner Service in the same HTTP session, containing an acknowledgement of receipt

of the transaction status.

Confirmation structure (XML)

<?xml version="1.0" encoding="UTF-8"?>

<confirmationList>

<serviceID>ServiceID</serviceID>

<transactionsConfirmations>

<transactionConfirmed>

<orderID>OrderID</orderID>

<confirmation>Confirmation</confirmation>

</transactionConfirmed>

</transactionsConfirmations>

<hash>Hash</hash>

</confirmationList>

Description of the confirmation fields for immediate notifications

IMPORTANT! The order of attributes for the Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | serviceID | YES | string{1,10} | Partner Service ID derived from the message. |

| 2 | orderID | YES | string{32} | The transaction identifier, assigned in the Partner Service and communicated in the start of the transaction, derived from the message. |

| 3 | confirmation | YES | string{1,25} | The element is used to convey the status of verification of the authenticity of the transaction by the Partner Service. The value of the element is determined by checking the correctness of the values of the serviceID and currency parameters, comparing the values of the orderID and amount fields in the notification message and in the message initiating the transaction, and verifying the consistency of the calculated hash from the message parameters with the value passed in the message hash field. Exceptions are models where the commission is added to the transaction amount. In such cases, the amount value in the ITN is increased by this commission. Amount validation can then be carried out on the basis of the optional ITN field startAmount. However, this field must be requested during integration. Two values are provided for the element confirmation:

|

| nd. | hash | YES | string{1,128} | The hash element (in the message response) is used to authenticate the response and is calculated from the values of the response parameters. For a description of how the hash is calculated, see the section Security of transactions. |

In the absence of a correct response to the sent notifications, the System will make further attempts to communicate the latest status of the transaction after the specified time has elapsed. The Partner Service should perform its own business logic (e.g. confirmation email), only after the first <message about a given payment status.

TIP: It is worth taking a look at Message re-transmission scheme ITN/ISTN/IPN/RPAN/RPDN.

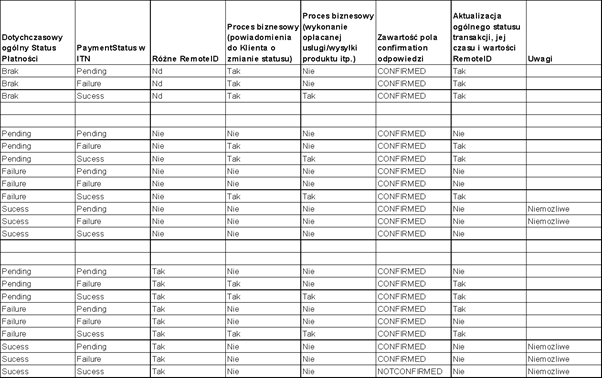

Detailed description of the behaviour and change of payment statuses (paymentStatus)

The customer's choice of payment method will send a status of PENDING each time. In the subsequent ITN message, the system will provide the status SUCCESS or FAILURE.

NOTE The PENDING status will not be sent if:

- the Customer abandons or returns from the payment method list screen without selecting a specific method. In this case, the FAILURE status will be sent immediately. The PENDING status will not appear as the customer has not started the payment process.

- The final status (SUCCESS or FAILURE) will be delivered before the ITN is sent with the status PENDING.

For a single transaction (with unique parameters OrderID and RemoteID), there can be no change of status from SUCCESS to PENDING or SUCCESS to FAILURE.

In any case, there may be a change of detail status - paymentStatusDetails (subsequent messages about a change of detail status are for information only and should not lead to a repeat of the paid service/product shipment, etc.).

In special cases of use, there may be a change of status:

a) FAILURE to SUCCESS (e.g. after an AP consultant has approved a transaction paid with an incorrect amount. Such behaviour requires special business arrangements and is not enabled by default),

b) SUCCESS to FAILURE (e.g. after triggering multiple transactions with the same OrderID but different RemoteID). Such a case occurs when a Customer initiates multiple payments with the same OrderID (e.g. the Customer changes his decision on which Payment Channel he wants to pay the transaction with). Each of the payments initiated by him generates ITNs and the individual transactions should be distinguished by the RemoteID parameter. As the time of receipt of the FAILURE status can vary greatly, it may happen that such a status is received after SUCCESS has been received (of course with a different RemoteID). In such a case, the ITN message should be acknowledged, but should not entail the cancellation of the transaction status in the Partner's system.

Handling transaction statuses from ITN - Simplified model

In a model where it is not necessary to notify the Customer by email/sms of non-SUCCESS statuses, the amount of information

stored in the Service database and the tracking of RemoteID changes can be reduced.

All You need is:

-

for statuses other than SUCCESS, each time confirm the ITN with the correct response structure, CONFIRMED status and correctly counted Hash field value,

-

in the event of receipt of First status SUCCESS, also add the update of the status, its time and RemoteID in the Service database and the execution of business processes (notifications to the Customer of status changes, execution of paid service/product shipment, etc.),

-

in the event of a subsequent SUCCESS status, each time confirm the ITN with a correct response structure, CONFIRMED status and correctly counted Hash field value, without updating the Service database and without business processes.

Handling transaction statuses from ITN - full model

In a model where the entire history of status changes of transactions and/or notification to the customer of major status changes

of transactions is needed, logic approximating the following description should be used.

Security of transactions

Description of transaction security

The Online Payment System uses several mechanisms to increase

the security of transactions carried out using it. Transmission between all parties to a transaction is carried out using a

secure connection based on the TLS protocol with a 2048-bit key.

In addition, the communication is secured by a hash function calculated from the values of the message fields and the shared key (the shared key itself is stored in the System in an encrypted form using the AES-ECB algorithm).

The SHA256 or SHA512 algorithm is used as the hash function (method determined at the stage of configuring the respective Partner Service in the online payment system). The default function is SHA256.

Calculation of the value of a hash function

Description of how to calculate the value of the hash function and examples of calculations for basic messages.

NOTE: The examples do not take into account all possible optional fields, so if such fields are present in a particular message, they should be included in the abbreviated function in an order consistent with the number next to the field.

Calculation of hash function value - Hash field

The value of the hash function, used to authenticate the message, is calculated from a string containing the concatenated fields of the message (concatenation of fields). Field values are concatenated, without parameter names, and a separator (in the form of the | character) is inserted between

consecutive (non-empty) values. The order in which the fields are glued together follows the order of their occurrence in the list of parameters in the documentation.

IMPORTANT! If there is no optional parameter in the message or in the case of an empty parameter value, do not use the separator!

To the string created in this way, a key is appended at its end, shared between the Partner Service and the online payment system. From the string created in this way, the value of the hash function is calculated and constitutes

the value of the message Hash field.

Hash = function(field_value_1_message + "|" + field_value_2_message + "|" + ... + "|" + field_value_n_message + "|" + shared_key);

Example calculation of the hash function value at the start of a transaction

Partner Service Data:

ServiceID = 2shared_key = 2test2

Gateway address https://{gate_host}/sciezka

a. Start of transaction

POST call without basket, with parameters:

ServiceID=2

OrderID=100

Amount=1.50

Hash=2ab52e6918c6ad3b69a8228a2ab815f11ad58533eeed963dd990df8d8c3709d1

where

Hash=SHA256(“2|100|1.50|2test2”)

b. Start of transaction. POST call with the shopping cart.

TIP: Option discussed in detail in section Product basket.

ServiceID = 2

OrderID = 100

Amount = 1.50

Product (described below)

shared_key = 2test2

Product basket (XML)

<?xml version="1.0" encoding="UTF-8"?>

<productList>

<product>

<subAmount>1.00</subAmount>

<params>

<param name="productName" value="Nazwa produktu 1" />

</params>

</product>

<product>

<subAmount>0.50</subAmount>

<params>

<param name="productType" value="ABCD" />

<param name="ID" value="EFGH" />

</params>

</product>

</productList>

After encoding with the base64 function, we get the value of the Product parameter:

PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiPz48cHJvZHVjdExpc3Q+PHByb2R1Y3Q+PHN1YkFtb3VudD4xLjAwPC9zdWJBbW91bnQ+PHBhcmFtcz48cGFyYW0gbmFtZT0icHJvZHVjdE5hbWUiIHZhbHVlPSJOYXp3YSBwcm9kdWt0dSAxIiAvPjwvcGFyYW1zPjwvcHJvZHVjdD48cHJvZHVjdD48c3ViQW1vdW50PjAuNTA8L3N1YkFtb3VudD48cGFyYW1zPjxwYXJhbSBuYW1lPSJwcm9kdWN0VHlwZSIgdmFsdWU9IkFCQ0QiIC8+PHBhcmFtIG5hbWU9IklEIiB2YWx1ZT0iRUZHSCIgLz48L3BhcmFtcz48L3Byb2R1Y3Q+PC9wcm9kdWN0TGlzdD4=

The Hash value is calculated as follows:

Hash=SHA256(“2|100|1.50|PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiPz48cHJvZHVjdExpc3Q+PHByb2R1Y3Q+PHN1YkFtb3VudD4xLjAwPC9zdWJBbW91bnQ+PHBhcmFtcz48cGFyYW0gbmFtZT0icHJvZHVjdE5hbWUiIHZhbHVlPSJOYXp3YSBwcm9kdWt0dSAxIiAvPjwvcGFyYW1zPjwvcHJvZHVjdD48cHJvZHVjdD48c3ViQW1vdW50PjAuNTA8L3N1YkFtb3VudD48cGFyYW1zPjxwYXJhbSBuYW1lPSJwcm9kdWN0VHlwZSIgdmFsdWU9IkFCQ0QiIC8+PHBhcmFtIG5hbWU9IklEIiB2YWx1ZT0iRUZHSCIgLz48L3BhcmFtcz48L3Byb2R1Y3Q+PC9wcm9kdWN0TGlzdD4=|2test2”)

Example calculation of the value of a hash function when returning a customer to the Partner Site

Partner Service Data:

ServiceID = 2

shared_key = 2test2

<https://shop_name/strona_powrotu?ServiceID=2>&OrderID=100&Hash=254eac9980db56f425acf8a9df715cbd6f56de3c410b05f05016630f7d30a4ed

gdzie

Hash=SHA256("2|100|2test2")

Example calculation of the value of a hash function in an ITN message

Partner Service Data:

serviceID = 1

shared_key = 1test1

ITN (XML)

<?xml version="1.0" encoding="UTF-8"?>

<transactionList>

<serviceID>1</serviceID>

<transactions>

<transaction>

<orderID>11</orderID>

<remoteID>91</remoteID>

<amount>11.11</amount>

<currency>PLN</currency>

<gatewayID>1</gatewayID>

<paymentDate>20010101111111</paymentDate>

<paymentStatus>SUCCESS</paymentStatus>

<paymentStatusDetails>AUTHORIZED</paymentStatusDetails>

</transaction>

</transactions>

<hash>a103bfe581a938e9ad78238cfc674ffafdd6ec70cb6825e7ed5c41787671efe4</hash>

</transactionList>

where

Hash=SHA256(“1|11|91|11.11|PLN|1|20010101111111|SUCCESS|AUTHORIZED|1test1”)

Example response (XML)

<?xml version="1.0" encoding="UTF-8"?>

<confirmationList>

<serviceID>1</serviceID>

<transactionsConfirmations>

<transactionConfirmed>

<orderID>11</orderID>

<confirmation>CONFIRMED</confirmation>

</transactionConfirmed>

</transactionsConfirmations>

<hash>c1e9888b7d9fb988a4aae0dfbff6d8092fc9581e22e02f335367dd01058f9618</hash>

</confirmationList>

where value

Hash=SHA256("1|11|CONFIRMED|1test1");

Example calculation of the hash function value in querying the list of Payment Channels

Partner Service Data:

ServiceID = 100

MessageID = 11111111111111111111111111111111

Currencies = PLN,EUR

Language = PL

shared_key = 1test1

where the value

Hash=SHA256('100|11111111111111111111111111111111|PLN,EUR|PL|1test1')

The response to the above call may be as follows (note: no hash field in the response):

{

"result": "OK",

"errorStatus": null,

"description": null,

"gatewayGroups": [

{

"type": "PBL",

"title": "Przelew internetowy",

"shortDescription": "Select the bank from which you want to order the payment",

"description": null,

"order": 1,

"iconUrl": null

},

{

"type": "BNPL",

"title": "Buy now, pay later",

"shortDescription": "Buy now, pay later",

"description": null,

"order": 2,

"iconUrl": null

}

],

"serviceID": "10000",

"messageID": "2ca19ceb5258ce0aa3bc815e80240000",

"gatewayList": [

{

"gatewayID": 106,

"name": "PBL test payment",

"groupType": "PBL",

"bankName": "NONE",

"iconURL": "https://testimages.autopay.eu/pomoc/grafika/106.gif",

"state": "OK",

"stateDate": "2023-10-03 14:35:01",

"description": "Test payment",

"shortDescription": null,

"descriptionUrl": null,

"availableFor": "BOTH",

"requiredParams": ["Nip"],

"mcc": {

"allowed": [1234, 9876],

"disallowed": [1111]

},

"inBalanceAllowed": true,

"minValidityTime": null,

"order": 1,

"currencies": [

{

"currency": "PLN",

"minAmount": 0.01,

"maxAmount": 5000.00

}

],

"buttonTitle": "Pay"

},

{

"gatewayID": 701,

"name": "Pay later with Payka",

"groupType": "BNPL",

"bankName": "NONE",

"iconUrl": "https://testimages.autopay.eu/pomoc/grafika/701.png",

"state": "OK",

"stateDate": "2023-10-03 14:37:10",

"description": "<div class=\"payway_desc\"><h1>Cost details</h1><p>Pay later - one-off up to 45 days (...). Offer details at: <a href="?r="https://payka.pl\" target=\"_blank\">Payka.pl</a></p></div>",

"shortDescription": "Pay later - in one go up to 45 days or in several equal instalments",

"descriptionUrl": null,

"availableFor": "B2C",

"requiredParams": [],

"mcc": null,

"inBalanceAllowed": false,

"minValidityTime": 60,

"order": 2,

"currencies": [

{

"currency": "PLN",

"minAmount": 49.99,

"maxAmount": 7000.00

}

],

"buttonTitle": "Pay"

}

]

}

Additional extensions

Alternative transaction initiation models

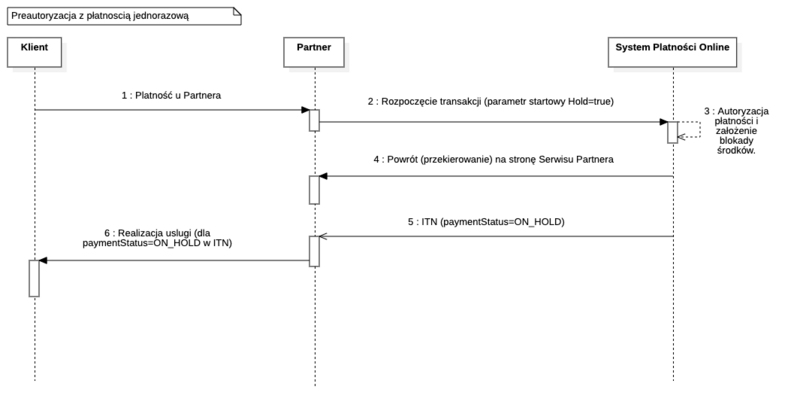

Card pre-authorisation

General description of the operation of the card pre-authorisation service

Card pre-authorisation support provides the functionality of blocking funds on the customer"s card for a certain (e.g. predetermined during the establishment of the blockade) period of time and then making a debit. A special case is when the block is removed without any amount being deducted (e.g. the service to the customer has not been performed).

All these operations (blocking of funds, debiting, withdrawal of blocking) should be ordered via the API of the Autopay Payment System. If there is no debit order to the card during the validity period of the transaction setting up the blockade, the System will release the funds, notifying you with a standard Transaction Status Change (ITN) message.

Other operations (successful debit, placing a block on the card and subsequent debit) also result in the sending of an ITN message. This message is the only binding information about a change in the status of a transaction and (used together with the service transactionStatus; see section Enquiry about the status of a transaction), helps to handle the transaction without breaking the session with the user (even in the event of various network problems). Synchronous operation acknowledgements (node confirmation, they serve only to present preliminary information about the order).

Steps in a card pre-authorisation transaction

Blocking at the request of the Partner

It is possible to distinguish between 3 basic ways of placing a lock on a card:

a) Establishing a block during the authorisation of a one-off payment (See Scheme A for Preauthorisation). The customer fills in the card format, after the transaction has been started, in which the Partner indicates in the start parameters:

- card payment channel (GatewayID=1500) and

- the desire to secure funds rather than encumber (Hold=true)

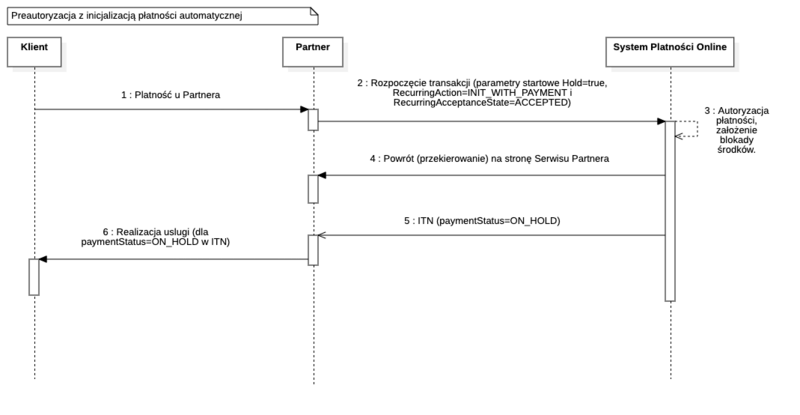

b) Assumption of a lock when initiating an automatic payment (card enrolment in the Service or Mobile Application) (See Scheme B for Preauthorisation)).

TIP: The automatic payment initialization process in the pre-authorization model (sending the RPAN message with ClientHash is started with the transactionClear service call.

NOTE: in this specific case, if the transaction will not be cleared in organizations - recursion cannot exist because the transaction has not been completed.

The customer fills in the card format, once the transaction has been started, in which the Partner indicates in the start parameters:

- card payment channel (GatewayID=1503),

- the fact of accepting the rules of the automatic payment service

provided by AP (RecurringAcceptanceState=ACCEPTED, lub po or after the business arrangements PROMPT/FORCE)- the choice to initialise an automatic payment with a potential debit to the card (RecurringAction=INIT_WITH_PAYMENT)

- the desire to secure funds rather than encumber (Hold=true)

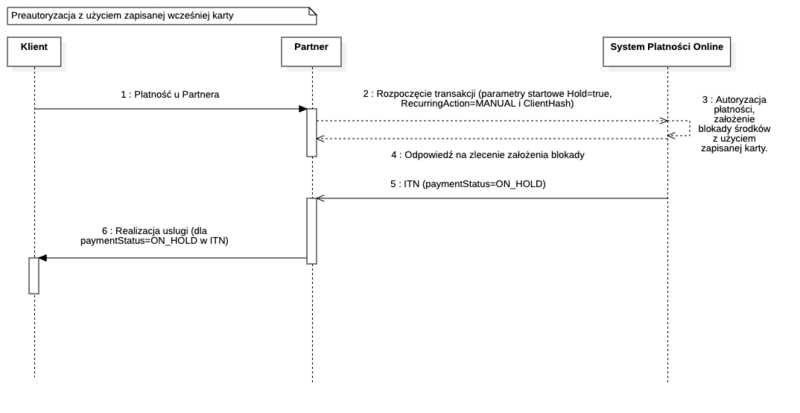

c) Establishing a lock using a previously saved card (see Scheme C for Preauthorisation).

TIP: The automatic payment initialization process in the pre-authorization model (sending the RPAN message with ClientHash is started with the transactionClear service call.

The customer does not fill in the card form, but a backend (without redirection) pre-transaction takes place in which the partner indicates in the start parameters:

- card payment channel (GatewayID=1503)

- indication of a previously added card (ClientHash from RPAN)

- choice of automatic payment method (RecurringAction=MANUAL)

- the desire to secure funds rather than encumber (Hold=true)

Each of these methods of establishing a blockade results in an ITN message, the status of which indicates the result of the transaction authorisation. In addition to the standard

statuses, in the case of blocking of funds, the System may provide in the ITN status paymentStatus=ON_HOLD, which confirms the establishment of a block of funds on the customer's card. In addition, the ITN will, as standard,

contain a global transaction identifier (remoteID), which will be required for subsequent loading of the established blockade.

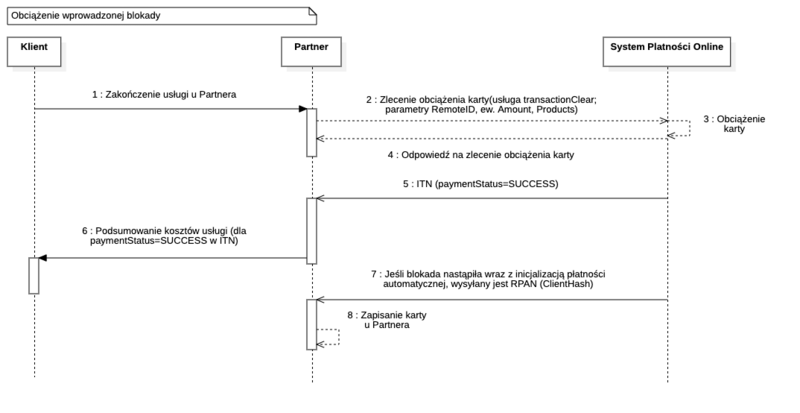

Card debit at the Partner's request

Description of the card charge at the partner's request

Once the lock has been placed, a debit order can be placed by the Partner

on a previously authorised card (See Scheme D for Preauthorisation).For

this purpose, the dedicated service must be called up: transactionClear

(https://{gate_host}/webapi/transactionClear) with the corresponding parameters. All parameters are passed via the POST method (Content-Type: application/x-www-form-urlencoded). The protocol is case-sensitive in both parameter names and values. The

values of the passed parameters should be encoded in UTF-8.

Description of available parameters for card debit at the Partner's request

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | ServiceID | YES | string{1,10} | Partner Service ID. |

| 2 | MessageID | YES | string{32} | Pseudo-random message identifier with a length of 32 Latin alphanumeric characters (e.g. on a UID basis), the field value must be unique and indicate a specific payment order on the Partner Service. |

| 3 | RemoteID | YES | string{1,20} | The alphanumeric transaction identifier assigned by the System and transmitted to the Partner in the ITN message of the incoming transaction. Its indication will result in a debit to the card authorized in the transaction of the indicated RemoteID, if it is in a blocked state (status ON_HOLD). |

| 4 | Amount | YES | amount | Amount of the debit (must not be greater than the amount of the blockade); a dot is used as decimal separator - '.' Format: 0.00. |

| 5 | Products | YES | string{1,10000} | Information about the products included in the transaction, transmitted as Base64 transport protocol encoded XML. The structure must include all products specified in the pre-authorisation, but can be simplified (only productID and idBalancePoint will be taken into account to identify the product whose amount is to be updated, and the new amount should be specified in subAmount). /Required for multiple products specified in the pre-authorisation. |

| nd. | Hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Partner Service. |

Confirmation of transaction for card debit at Partner's request

For correct querying, a defined HTTP header with appropriate content must be

sent along with the passed parameters. The attached

header should be named 'BmHeader' and have the following

value 'pay-bm, in its entirety it should look as follows 'BmHeader: pay-bm'. In case of a valid message, an XML-formatted text is returned (in the same HTTP session), containing confirmation of the operation or a description of the error.

Confirmation structure (XML)

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<balancePayoff>

<serviceID>ServiceID</serviceID>

<messageID>MessageID</messageID>

<remoteOutID>RemoteOutID</remoteOutID>

<hash>Hash</hash>

</balancePayoff>

Confirmation structure (XML)

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<balancePayoff>

<balancePointID>BalancePointID</balancePointID>

<messageID>MessageID</messageID>

<remoteOutID>RemoteOutID</remoteOutID>

<hash>Hash</hash>

</balancePayoff>

Description of parameters to be returned for card debit at the partner's request

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | serviceID | YES | string{1,32} | Partner Service ID. Derived from a method request. Required for confirmation=CONFIRMED. |

| 2 | messageID | YES | string{1,20} | Pseudo-random message identifier of 32 Latin alphanumeric characters in length (e.g. based on UID). Derived from the method request. Required for confirmation=CONFIRMED. |

| 3 | confirmation | YES | string{1,100} | Order acknowledgement status. It can take two values: - CONFIRMED – the operation was successful. NOTE: This does not mean that the load is executed! The system will asynchronously deliver the ITN with paymentStatus=SUCCESS. - NOTCONFIRMED – operation failed. |

| 4 | reason | NO | string{1,1000} | Explanation of the details of the processing of the request.. |

| nd. | hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Partner Service. Required for confirmation=CONFIRMED. |

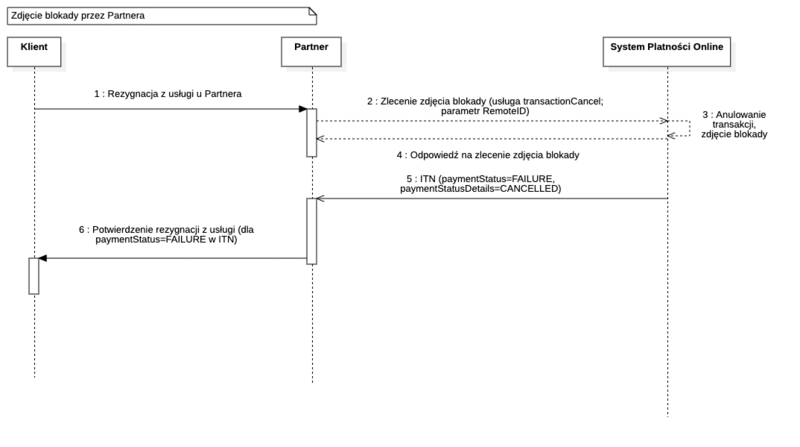

Release of blocking at the request of the Partner

Once the lock has been established, it can be ordered by the Partner to release it without any deduction of any funds (See Scheme E for Preauthorisation)). For this operation, use the service releaseHold

(See Cancellation of an unpaid transaction). Upon successful initiation of a lock release (correct response to a cancel

transaction), the System will asynchronously provide an ITN with the

paymentStatus=FAILURE and paymentStatusDetails=CANCELLED.

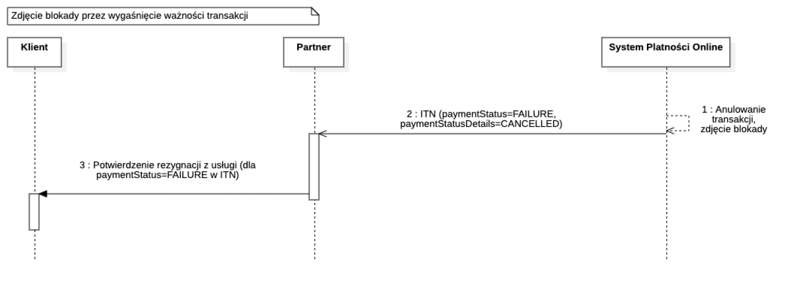

Release of blocking after overdue transactions

In the event of Partner's inactivity (after the lock has been set up) for a predetermined

period of validity, the transaction is released by the System (without

deducting any funds) (See Scheme F for Preauthorisation). The system will cancel the transaction, remove the lock and provide the ITN with the paymentStatus=FAILURE and paymentStatusDetails=CANCELLED.

Schemes for Preauthorisation

Scheme A for Preauthorisation: Setting up a block during the authorisation of a one-off payment

Scheme B for Preauthorisation: Assumption of a block during the initiation of an automatic payment (card enrolment)README.md

Scheme C for Preauthorisation: Setting up a lock using a previously stored card

Scheme D for Preauthorisation: Partner's order to debit a previously authorised card

Scheme E for Preauthorisation: Order by Partner to release the lock (without deducting funds)

Scheme F for Preauthorisation: Release of lock by the Scheme (without deduction of funds)

Pre-transaction

Pre-transaction description

Pre-transaction extends the standard transaction initiation model by handling specific needs:

-

order a payment link on the basis of the submitted parameters

-

debit from the customer (if no additional authorisation is required by the Customer)

-

verify the correctness of the payment link before the Customer is redirected to the System - the call results in the validation of the parameters and configuration of the System

-

shorten the payment link - instead of several/several parameters, link is shortened to two identifiers

-

hiding the data of sensitive parameters of the transaction link - the pre-transaction takes place in the backend, and the link to continue the transaction does not contain sensitive data, but only identifiers of the continuation of

-

use of the mobile SDK in a mixed variant - the start of the transaction is performed by the mobile app backend, rather than the SDK itself using the transaction token

The specific use cases of Pre-transaction, are loads:

-

BLIK 0\ In order to use this service, you must provide GatewayID=509 and pass the transaction authorisation code in the parameter AuthorizationCode.

-

BLIK 0 OneClick

-

Charges for "Automatic payment"

In order to use this service, you must provide one of the GatewayID=509 i gatewayType="Płatność automatyczna" and the necessary parameters. -

Authorisations through Visa wallets

In order to use this service, you must provide GatewayID=1511 and pass the encoded token in the parameter PaymentToken. In the absence of a token, authorisation will take place on the System website. -

Authorisations through Google Pay wallets

NOTE: The service allows the card stored in the customer's wallet to be debited without redirection to the System. Often, additional authorisation is enforced in the form of 3DS (default behaviour of the test environment, which can be reconfigured).

In the Whitelabel model, integrate as described and then provide GatewayID=1512 and the encoded token in the PaymentToken parameter. If there is no token (or a model other than Whitelabel), simply enter GatewayID=1512 - authorisation will take place on the System website.

-

Authorisations through Apple Pay wallets

To use this service, you will need to enter GatewayID=1513. Authorisation will take place on the System website. -

Authorisation through the native format of the mobile SDK

NOTE: The service allows the card to be debited, the details of which are provided on the secure card format of the SDK, and the start of the transaction itself is performed by the backend of the mobile application.

In addition to the relevant GatewayID - 1500 for a one-time payment or 1503 for activation of an automatic payment (and other parameters) - the PaymentToken obtained from the SDK and the parameter WalletType=SDK_NATIVE (description in section Starting a transaction with additional parameters)

Calling a Pre-transaction

A required element in the case of a pre-transaction is to send backend (using e.g. cURL) the standard start message of the transaction (see Start of the transaction), with a 'BmHeader' of value: 'pay-bm-continue-transaction-url':

Example of a header

'BmHeader: pay-bm-continue-transaction-url')

In addition, it is recommended that the parameter CustomerIP (for claims, reporting purposes).

Example of Pre-transaction start-up (PHP)

$data = array(

'ServiceID' => '100047',

'OrderID' => ‘20161017143213’,

'Amount' => '1.00',

'Description' => 'test bramki',

'GatewayID' => '0',

'Currency' => 'PLN',

'CustomerEmail' => 'test@bramka.pl',

'CustomerIP' => '127.0.0.0',

'Title' => 'Test title',

'Hash' => 0c5ca136e8833e40efbf42a4da7c148c50bf99f8af26f5c9400681702bd72056

);

$fields = (is_array($data)) ? http_build_query($data) : $data;

$curl = curl_init('https://{gate_host}/test_ecommerce');

curl_setopt($curl, CURLOPT_HTTPHEADER, array('BmHeader: pay-bm-continue-transaction-url'));

curl_setopt($curl, CURLOPT_POSTFIELDS, $fields);

curl_setopt($curl, CURLOPT_POST, 1);

curl_setopt($curl, CURLOPT_RETURNTRANSFER, true);

curl_setopt($curl, CURLOPT_SSL_VERIFYPEER, true);

$curlResponse = curl_exec($curl);

$code = curl_getinfo($curl, CURLINFO_HTTP_CODE);

$response = curl_getinfo($curl);

curl_close($curl);

echo htmlspecialchars_decode($curlResponse);

Response to Pre-transaction - link to follow up on transaction

In the case of correct validation of the parameters (and configuration) and

the need for the customer to perform an additional action (selecting a

payment channel - if specified GatewayID=0, execution/confirmation transfer, entering CVC/CVV code, execution of 3DS) - an XML with a link to continue the transaction will be returned.

Example of a transaction continuation link file (XML)

<?xml version="1.0" encoding="UTF-8"?>

<transaction>

<status>PENDING</status>

<redirecturl>

https://{gate_host}/payment/continue/96VSD39Z6E/L6CGP5BH

</redirecturl>

<orderID>20180824105435</orderID>

<remoteID>96VSD39Z6E</remoteID>

<hash>

1c6eae2127f0c3f81fbed3b6372f128040729a4d4e562fb696c22e0db68dbbe1

</hash>

</transaction>

Pre-transaction object

The transaction object represents the receipt or withdrawal of funds from an AP, such as a completed purchase or refund.

Transaction object attributes for Pre-transaction

IMPORTANT! The order of attributes for the Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | status | YES | string{1,32} | Transaction status. In this case the constant PENDING. |

| 2 | redirecturl | YES | string{1,100} | Address to continue a transaction initiated by a pre-transaction message. |

| 3 | orderID | YES | string{1,32} | The transaction identifier assigned in the Partner Service and communicated at the start of the transaction. |

| 4 | remoteID | YES | string{1,20} | The unique transaction identifier assigned in the AP System. |

| nd. | hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Service. |

Response to Pre-transaction - no continuation of transaction

In the event of an invalid validation or unsuccessful load no continuation link is generated. A text in XML format is returned (in the same HTTP session) indicating the processing status of the request.

Example of request processing status (XML)

<?xml version="1.0" encoding="UTF-8"?>

<transaction>

<orderID>OrderID</orderID>

<remoteID>RemoteID</remoteID>

<confirmation>ConfStatus</confirmation>

<reason>Reason</reason>

<blikAMList>

<blikAM>

<blikAMKey>Klucz1</blikAMKey>

<blikAMLabel>Etykieta1</blikAMLabel>

</blikAM>

<blikAM>

<blikAMKey>Klucz2</blikAMKey>

<blikAMLabel>Etykieta2</blikAMLabel>

</blikAM>

</blikAMList>

<paymentStatus>PaymentStatus</paymentStatus>

<hash>Hash</hash>

</transaction>

Pre-transaction outcome

Parameters returned for the result of the Pre-transaction.

IMPORTANT! The order of attributes for Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | orderID | YES | string{1,32} | The transaction identifier assigned in the Partner Service and communicated at the start of the transaction. Required for confirmation=CONFIRMED. |

| 2 | remoteID | YES | string{1,20} | The unique transaction identifier assigned in the AP System. Required for confirmation=CONFIRMED. |

| 3 | confirmation | YES | string{1,100} | Order acknowledgement status. It can take two values: - CONFIRMED – the operation was successful. NOTE: Does not indicate success. - NOTCONFIRMED – operation failed. |

| 4 | reason | NO | string{1,1000} | Explanation of the reason for rejection of the order (for confirmation=NOTCONFIRMED), if available. |

| 5 | blikAMList | NO | string{1,10000} | List of available mobile bank applications under BLIK 0 OneClick option (for confirmation=NOTCONFIRMED and reason=ALIAS_NONUNIQUE). |

Format for blikAMList: |

||||

| 6 | paymentStatus | NO | enum | Transaction authorisation status, takes values: - PENDING – transaction initiated - SUCCESS – correct authorisation of transactions - FAILURE – transaction not completed correctly |

| nd. | hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Service. Required for confirmation=CONFIRMED. |

Correct validation of parameters

If the parameters (and configuration) are validated correctly and there is no need for the customer to perform an additional action - a confirmation of the load order is returned.

This is the case where the data is sufficient to make a debit for the payment channel in question, for example: BLIK 0 without

the required BLIK code (nor indication of the bank's mobile app alias), recurring payment, OneClick Card payment without the required CVC/CVV/3DS.

Result

confirmation=CONFIRMED

Incorrect parameter validation

In the event of incorrect parameter (and configuration) validation - an error is returned.

Result

confirmation=NOTCONFIRMED

An error may also be returned in the event of a synchronous response from the Payment Channel (e.g. an error specific to an attempt to initialise a BLIK automatic payment, i.e. reason= RECURRENCY_NOT_SUPPORTED).

NOTE: An error may also be returned in the event of a synchronous response from a Payment Channel (e.g. an error specific to an attempt to initialise a BLIK automatic payment, i.e. reason=RECURRENCY_NOT_SUPPORTED). Another known case is also the validation error of the address given in the start parameter CustomerEmail (INVALID_EMAIL).

Handling of responses for Transactions

| Confirmation status (confirmation) | Payment status (paymentStatus) | Description of the Partner's behaviour |

|---|---|---|

| CONFIRMED | SUCCESS | Transaction accepted for processing, status correct. Do not retry debit The payment confirmation can be displayed, but business processes should be paused until the confirmation in the ITN (this will be sent once the AP has received the correct transaction status from the Payment Channel). |

| CONFIRMED | FAILURE | Transaction accepted for processing, status invalid. You can retry debit with the same OrderID. Once the AP has received the status of the transaction from the Payment Channel, an ITN message will be sent. NOTE: It is not possible to retry transaction with the same OrderID if, during integration, a model is agreed for the System to block transaction starts with the same OrderID. By default, the Partner's preservation of the uniqueness of the OrderID is only a recommendation and is not subject to verification in transaction starts. |

| CONFIRMED | PENDING | A transaction has been accepted for processing, but its status is not yet known. Do not retry the load. Further handling as in the case of timeout. |

| NOTCONFIRMED | - | Transaction not ordered (reason indicated in reason node). You can retry the load with the same OrderID. |

| Timeout (or other response such as invalid structure, missing required fields, other confirmation status) | - | Wait for the ITN until the expiry date of the transaction (a short expiry time, e.g. 15 min, is recommended for this purpose), informing the customer of the result in a separate process (email/sms). After this time, it is recommended to query the transaction status (transactionStatus). If the method returns no registered transaction (or FAILURE payment statuses alone), the debit order can be retried with the same OrderID. Alternatively, you can try to cancel the transaction, thus speeding up the process of obtaining the final transaction status and possibly the process of renewing the transaction start message. To do so, use the transaction cancellation service (transactionCancel) and confirm its operation by querying the transaction status (as described above). |

Requesting transfer details for a Fast Transfer transaction

Description of ordering transfer data in a Fast Transfer transaction

Fast Transfer is a form of payment that requires the Customer to independently rewrite the transfer data provided by the System. What type a given Payment Channel is, is told by the gatewayType parameter in response to calling the service "Querying the list of currently available

Payment Channels". The transfer data can be displayed to the Customer:

-

on the AP website (execution of the transaction based on the standard transaction start model described in part Start of the transaction)

-

on the Partner's site (transaction processing without redirecting the customer to the AP site is described below)

Calling

For the correct transmission of the message, a standard transaction start message must be sent backend (e.g.

cURL), with a header 'BmHeader' of value: 'pay-bm' (In its entirety, the header should look as follows 'BmHeader: pay-bm'). If the header is incorrectly defined or missing, the message will be misread. In addition, it is recommended to pass the CustomerIP parameter as described under User IP (needed for complaint, reporting processes) and required to pass a non-zero GatewayID parameter (with gatewayType "Fast Transfer"`").

Implementation of background transaction start (PHP)

$data = array(

'ServiceID' => '100047',

'OrderID' => '20150723144517',

'Amount' => '1.00',

'Description' => 'test bramki',

'GatewayID' => '71',

'Currency' => 'PLN',

'CustomerEmail' => 'test@bramka.pl',

'CustomerIP' => '127.0.0.0',

'Title' => 'Test title',

'ValidityTime' => '2016-12-19 09:40:32',

'LinkValidityTime' => '2016-07-20 10:43:50',

'Hash' => 'e627d0b17a14d2faee669cad64e3ef11a6da77332cb022bb4b8e4a376076daaa'

);

$fields = (is_array($data)) ? http_build_query($data) : $data;

$curl = curl_init('https://{gate_host}/test_ecommerce');

curl_setopt($curl, CURLOPT_HTTPHEADER, array('BmHeader: pay-bm'));

curl_setopt($curl, CURLOPT_POSTFIELDS, $fields);

curl_setopt($curl, CURLOPT_POST, 1);

curl_setopt($curl, CURLOPT_RETURNTRANSFER, true);

curl_setopt($curl, CURLOPT_SSL_VERIFYPEER, true);

$curlResponse = curl_exec($curl);

$code = curl_getinfo($curl, CURLINFO_HTTP_CODE);

$response = curl_getinfo($curl);

curl_close($curl);

echo htmlspecialchars_decode($curlResponse);

Answer - transfer details

In the case of payments of this type, the System generates a set of data

needed to make an intra-bank (and therefore fast) transfer to the AP bank account. This data is placed in the response to the start of the transaction, in an xml document.

Payment system response to the start of the transaction (XML)

<?xml version="1.0" encoding="UTF-8"?>

<transaction>

<receiverNRB>47 1050 1764 1000 0023 2741 0516</receiverNRB>

<receiverName>Autopay</receiverName>

<receiverAddress>81-718 Sopot, ul. Powstancow Warszawy 6</receiverAddress>

<orderID>9IMYEH2AV3</orderID>

<amount>1.00</amount>

<currency>PLN</currency>

<title>9IMYEH2AV3 - weryfikacja rachunku</title>

<remoteID>9IMYEH2AV3</remoteID>

<bankHref>https://ssl.bsk.com.pl/bskonl/login.html</bankHref>

<hash> fe685d5e1ce904d059eb9b7532f9e06a64c34c1ea9fcf29b62afefdb7aad7b75 </hash>

</transaction>

List of returned parameters for the response

IMPORTANT! The order of attributes for Hash enumeration must follow their numbering.

| Hash order | name | required | type | description |

|---|---|---|---|---|

| 1 | receiverNRB | YES | string{32} | Account number of the recipient of the transfer (AP). |

| 2 | receiverName | YES | string{1,100} | Name of the recipient of the transfer (AP). |

| 3 | receiverAddress | YES | string{1,100} | Address details of the recipient of the transfer (AP). |

| 5 | orderID | YES | string{1,32} | The transaction identifier assigned in the Partner Service and communicated at the start of the transaction. |

| 6 | amount | YES | amount | Transaction amount. A full stop - '.' - is used as decimal separator. Format: 0.00; maximum length: 14 digits before the decimal point and 2 after the decimal point. NOTE: The permissible value of a single Transaction in the Production System is min. 0.01 PLN, max. 100000.00 PLN (or up to the Bank's individual single Transaction limit for an intra-bank transfer). |

| 7 | currency | YES | string{1,3} | Transaction currency. |

| 8 | title | YES | string{1,140} | The full title of the transfer (ID together with the Description field from the start of the transaction). |

| 9 | remoteID | YES | string{1,20} | The unique transfer identifier assigned in the AP System. |

| 10 | bankHref | YES | string{1,100} | The login address in the online banking system, which can be used to create a 'Go to bank' button. |

| nd. | hash | YES | string{1,128} | Value of message digest function calculated as described in section Security of transactions. Mandatory verification of compliance of the calculated abbreviation by the Service. |

NOTE: The above information should be used to display transfer data and redirect the user to the bank's login page.

BLIK 0 OneClick payment

Description of BLIK 0 OneClick payments

This is a dedicated solution for BLIK payments, allowing you to payment without entering your BLIK code (and without having to leaving the Website). Its successful initiation in the System causes automatic activation/awakening of the bank's mobile application and presenting the transaction to the User for confirmation.

Potential benefits:

-

making available the first convenient and secure payment method in mCommerce that does not require a card number opens this segment to new customers,

-

better customer shopping experience - pays faster and more conveniently,

-

shopping frequency and customer value over time - customers are more willing to and more often buy from those shops where the shopping process is more convenient,

-

conversion rate - the service has greater control over the process of purchase and payment process (the customer does not abandon it), the risk of basket loss,

-

fast transaction decision - in a short time the transaction is subject to authorisation, refusal or cancellation,

-

The service has the possibility to analyse the very stage of making the payment.

The condition for BLIK 0 OneClick to be made available to the Customer is to have been authorised on the Service (having an account and having previously logged into it). If, during a previously executed BLIK payment, together with other payment information, the Service has sent a dedicated UID Alias (description of the parameters BlikUIDKey and BlikUIDLabel in another part of the document), and the Customer, while confirming the payment in the mobile application indicated that he or she wished to remember the shop, this resulted in a permanent association (typically for a period of 2 years) of the Service Customer with his/her application, i.e. Alias UID registration. Its subsequent use will result in authorisation of the transaction without entering the code.

Calling BLIK 0 OneClick payments

When selecting a BLIK Payment Channel, it is recommended not to force the user to enter a BLIK code. Instead, it is advisable to display the ‘I want to enter my BLIK code BLIK’ hyperlink under the “Buy and pay” button to enable entering the code in the first attempt (in case the Customer would like to make a BLIK payment from a different mobile application than the one in which he/she has previously saved a given Service).

The Service should perform the Pre-Transaction, paying particular attention to the following on:

-

specifying the parameter GatewayID = 509 - indicating the payment channel BLIK,

-

providing BlikUIDKey and BlikUIDLabel parameters - indicating BLIK 0 OneClick Alias UID (User ID) required by BLIK 0 OneClick. user)

-

providing the AuthorizationCode parameter - if the customer provided the code BLIK,

-

providing BlikAMKey parameter - if the Customer specified a label of the of the bank's mobile application from the list presented on the Website,

-

handling possible responses to pre-transaction, including handling ‘Response - no continuation’ and BLIK-specific errors 0 OneClick:

a) error of many mobile applications of the bank (confirmation=NOTCONFIRMED and reason=ALIAS_NONUNIQUE) - displaying the list of labels returned in the pre-transaction aliases list (key + label pairs contained in the BlikAMList structure), in order to retrieve the selected key and provide it in the BlikAMKey parameter of the next pre-transaction attempt

b) authorisation errors (confirmation=NOTCONFIRMED and reason with one of the values: ALIAS_DECLINED, ALIAS_NOT_FOUND, WRONG_TICKET, TICKET_EXPIRED, TICKET_USED) - display the Blik Code field, in order to retrieve it and provide it in the AuthorizationCode parameter of the next pre-transaction attempt

Google Pay

Description

Google Pay is an instant and intuitive payment system from Google. It allows the user to complete the payment process without completing a card form, as the card details are stored securely on the company's servers.

Google Pay is a product that allows encrypted data of the customer's payment card to be obtained allowing it to be debited.

In order to pay via Google Pay, you need to save your payment card to your Google account, using any Google platform (e.g. buying apps on Google Play) or directly on the Google Pay.

NOTE: The service requires the prior signing of a contract with the card operator. Please contact the Autopay Business Department for details.

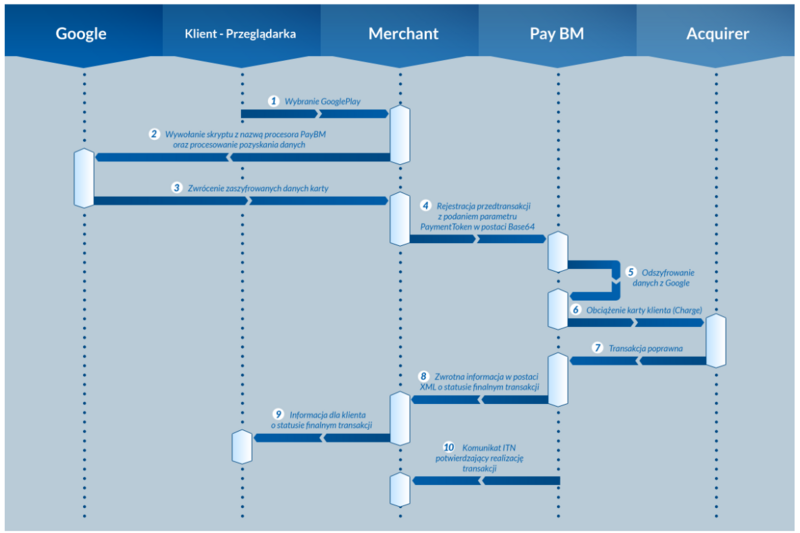

Communication scheme

After clicking on ‘Pay with Google Pay’, a Google Pay form appears on the shop page. In it, the customer confirms his Google account and the card he intends to pay with (he can also change to another card or add a new one at this stage). The script transmits the encoded card data in the background via the postMessage function, then the shop has to accept and encode it via the base64 function and finally send it in the PaymentToken parameter along with the other parameters (transaction data).

On its website, the shop must call up the script provided by Google with the payment processor's details changed.

TIP: Details in Google developer documentation.

Detailed scheme of communication and data exchange

Detailed scheme of communication and data exchange

Google Pay transaction registration